Given the strategic importance of the cloud and size of cloud expenditures, it’s critical for enterprises to have solid controls in place to manage it all. According to our latest research, however, while most organizations agree with that sentiment, very few have put it into practice. There are distinct but related disciplines that come into play: FinOps and cloud governance. In this two-part series, we explore current state of each.

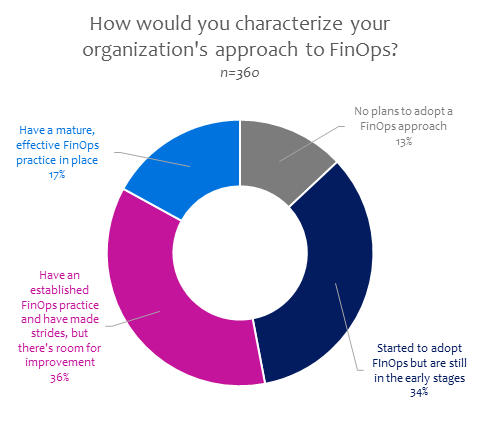

The goal of FinOps is to bring financial accountability to the variable spend model of the cloud to enable teams to make more informed business trade-offs between speed, cost, and quality. We asked 360 cloud decision-makers to characterize their organization’s approach to FinOps. Here’s what they told us:

Only 17% have a mature, effective FinOps practice in place.

It’s not surprising that this number is so low given that FinOps is a relatively new discipline. It takes time to put all the right pieces in place, skill up the right people, and align all the right resources. These organizations are likely early FinOps adopters that can help guide the way for everyone else. According to the FinOps.org maturity model, which uses a crawl-walk-run metaphor, runners are seeing excellent results in the following areas: spend allocation, resource-based commitments discount target coverage, forecast to actual spend variance, and ability to address difficult edge cases. This is due to two key factors. First, the FinOps capability is well understood and followed across all teams in the organization. And second, they’ve automated as much as possible. Given the highly dynamic nature of the cloud, however, you’re never “done” when it comes to FinOps. At this stage, enterprises are making the best possible decisions to get the best performance at the lowest cost and risk and can focus on incremental adjustments and refinements to their FinOps practice rather than step-change improvements.

36% have an established FinOps practice and have made strides, but there’s room for improvement.

These are the “walkers.” They’ve cut some waste and solved some of their bigger challenges but likely have had to work around some continuing hurdles to get to this point. Maturing their FinOps practice and capabilities will require eliminating those hurdles. To do this, you need to determine exactly how the challenges you’re currently working around can be solved:

- Do you need more data? If there is information that you simply cannot get, you will have big gaps in your decision-making capabilities.

- Do you need more granular data? If the problem is at the level of detail available—that is, you can’t break down the data sufficiently—you are likely missing nuances that should be factored into your decisions.

- Do you need more flexibility in how you can analyze the data? Similarly, the problem could be that you can’t manipulate the data based on the specific needs and structure of your enterprise.

- Do you need consolidated data? If you have what you need, but it comes from disparate systems and can’t easily be combined into a comprehensive view, you can end up missing the forest for the trees.

- Do you need to streamline the process of getting the insights you need? Even if you can accomplish all of the above, if it’s a manual and time-consuming process to get there, you’re not as efficient and agile as you could be.

Once you understand what’s keeping you from breaking into a FinOps “run,” you can create a plan to address it.

34% have started to adopt FinOps but are still in the early stages.

A significant number of enterprises are merely crawling. They’re starting to put the pieces in place and are likely going after the lowest-hanging fruit. Perhaps they haven’t gotten all the relevant stakeholder groups on board yet. They’ve only just begun to define the basic processes and policies needed. And chances are, they’re focused on getting basic reporting and tooling in place, with automation being deferred as a next-phase concern. For these organizations, finding ways to accelerate progress can help facilitate adoption across functions and deliver more bottom-line value faster. This requires investing in tools that:

- Connect across multiple cloud service providers

- Allow you to start creating value fast but offer advanced capabilities to scale as you mature

- Are flexible enough to support analysis and reporting that reflects your organization’s specific requirements, structures, and risk profiles

- Integrate with existing tools and workflows

13% have no plans to adopt a FinOps approach.

Considering that 98% of organizations surveyed have workloads running in the public cloud, this is surprising. Perhaps they believe they’re already optimized enough in the cloud. But, as the FinOps Foundation points out, FinOps isn’t simply about saving money. Making smarter cloud spend decisions across the board does more than just support operational efficiency. It can drive more revenue, grow the customer base, and accelerate the velocity of strategic product and feature releases. In other words, it’s ultimately about making money. If you’re among this small minority, it’s worth considering if you could benefit from increased cloud financial accountability across the enterprise—regardless of whether you follow the FinOps Foundation model or even call it FinOps.

Wherever you are in your FinOps journey, Virtana can help.

With Virtana Platform, you can manage your entire IT infrastructure with a multi-cloud management platform to radically simplify the optimization, migration, and monitoring of application workloads across public, private, and hybrid cloud environments. Using Virtana Cloud Cost Management, you can better manage your hybrid cloud IT infrastructure by optimizing cost, capacity, and performance in real time on an ongoing basis. Try Virtana Cloud Cost Management for free.

Get the survey report: The State of Multi-Cloud Management 2022

Optimize your hybrid, multi-cloud workloads: Try Virtana Cloud Cost Management for free

Jaime Banuelos